Changelog

1.27

-

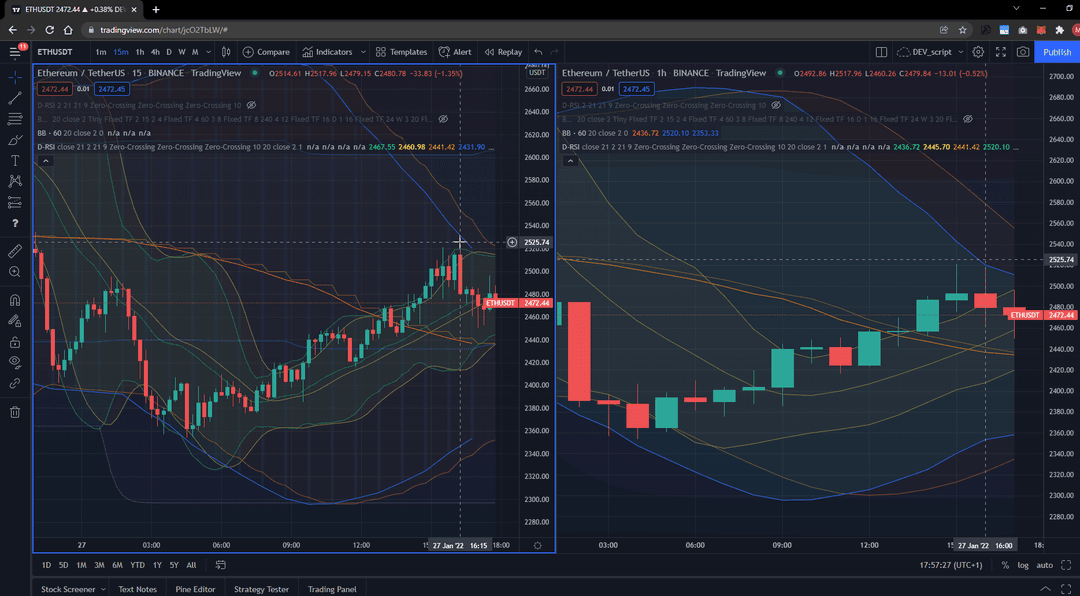

D-RSI crossover

-

Bollinger Band Accuracy

security mismatching fixed (pine script exploit)

- Bollinger Band Fuzziness on higher TFs fixed (edges, steps)

1.33

-

VuManChu scripts utilisation: Accurate Wavetrend, False D-RSI, Volume Convergence

-

improved securities management

-

added TFs to new VMC indicator

-

added colours for various TFs

1.44

- fixed crossunder function backtesting issue

1.46

-

BB "offset" via Std deviation

-

strategy logics improvement

-

IF clauses streamlined

2.17

- Probability indicators (first step to Buyphase implementation)

- sigmoid function implementation for "smooth bools"

2.2

-

Buyphases implemented

-

Bollinger Bands receive "Exceeded Upper", "Dipped Lower" and "Reset" condition, values and handler on TF Level

-

increased complexity on golong / endlong conditions handled

-

securit limitation handled

2.53

-

immediate re-entry bug for unique market scenario fixed

-

Multi-TF correlation: "Handing down" signals from top TF to lowest TF

-

BuyPhase aggregation: strategies can await BBdipped + next occurring signal from now on

-

BuyPhase receives neutral element for contradicting intel for each TF

2.89

- BBdipped resetting options amended: (BB mid, BP change, BBdipped / BB exceeded, Endlong condition)

3.03

-

thisTF adoption: Added "thisTF" to all indicators, visualisations and TFs

-

Securities limit reached - stripping wavetrend function further from securities for thisTF as well. Added new subfunction "f_wavetrend_simpl"

4.0

-

Multi-strategy architecture available.

-

Playbook introduction: Market Scenario + Strategy = Plabook Entry. Each strategy will only be applied when a certain market condition is met. Currently we handle Mean Reverse, Momentum Trading, Buy the Dip, Follow the Trend and Divergences

4.10

- Introduced fixed colour set for TFs:

| TimeFrame | colour |

|---|---|

| 1m | white |

| 15m | green |

| 1h | yellow |

| 4h | blue |

| 1D | purple |

| 1W | red |

4.25

-

ready to introduce multi-level indicator linking, enabling higher security limits, but creates riskful blackboxing. encourage to avoid.

-

hedging ready

4.28

- top-down BP trends across TFs: each BuyPhase will consider it's higher TF conditionally for it's own calculation. This is highly recursive and a major routine.

4.31

- BBdipped sensitivity improved across TFs

4.32

-

structured procedure to add new indicator in order to aggregate all indicators as Buyphases

-

thisTF = drivingTF definition and respective handling.

-

Plausibility of thisTF: "sideways" activity recognition

-

occasional D-RSI flimmer fixed by substitution of crossover / crossunder for core function.

4.433

- proprietary indicator "TF Dominance" defining the TF significance, developed from scratch and integrated.

4.435

- TF Dominance receives threshold to define if it's in the lead.

| colour | interpretation |

|---|---|

| filled green | 15m is stronger than 1h -> skip 1h signals and consider 15m instead |

| filled yellow | 1h is stronger than 4h -> skip 4h signals and consider 1h instead |

| filled blue | 4h is stronger than 1D |

4.436

-

Shorting conditions received similar logic to long, but with dedicated weighting parameters in auto-adjusting.

-

Backtesting improvements in accuracy and position handling

-

higher TF Bollinger Bands stretching considerably in live data. Handled accordingly

4.437

-

Added Take Profit to look at lowest TP ("smart TP")

-

avoiding re-entry in same cycle on thisTF

4.441

- proprietary indicator "Cycle Length" defining the approximate length of each cycle, developed from scratch and integrated.

- replaced "close" input by " low" for trailing TP calculation

4.442

- introducing TF invalidation / TF Anomaly in case that neutral BP is not enough and the data is currently out of reasoning. Deeply mechanical opportunities are still recognized.

- BP connection bug fixed.

4.443

-

BP Visuals improvement

-

Cycle length revised. Applying EMA and gauss smoothing techniques to have immediate wave assumptions without timewise offset. Added assumptions for measuring length via crossover vs. amplitude

4.5

-

Dollar Cost Averaging Step 1

-

Leverage Step 1

Outlook

DCA

- Max positions auto backtesting for strategy: how many positions do we need with our logic to be always profitable. (goal-seeking challenge for AI)

- Position Size: flexible sizing of the positions in accordance to the probability would genuinely change the performance.

- Which TF to remember? Is this a question to be challenged?

- self-testing routines ○ DCA: how many positions needed? (covering accuracy of algorithm) ○ maximum DrawDown of a position?

- Smart Take Profit

- Trailing Stop Loss improvements

- Drawdown auto backtesting + leverage application.

- Total Account Liquidation Prevention: Margin Call Calculation for each account.

- cycle length gets minimum, maximum, average

- order handler improvement.